Each mortgage is related to a percentage

To get a mortgage (Dutch: “hypotheek”)

If you buy a house, usually you need a mortgage (loan). To get a mortgage from the bank, there are important steps to follow:

Figure out your budget: Before applying for a mortgage, you need to understand how much money you can afford to borrow. Consider your income, expenses, and savings to determine a budget for buying a house.

Research mortgage options: There are different types of mortgages offered by banks, each with its own terms and interest rates. Look into different lenders and compare their mortgage options to find one that fits your needs. Common types include fixed-rate and adjustable-rate mortgages.

Gather necessary documents: To apply for a mortgage, you’ll need to provide specific documents to show your financial situation. These may include proof of income (like pay stubs or tax returns), bank statements, identification, employment verification, and details about any existing debts or loans.

Find a property and make an offer: Once you know your budget, start looking for a suitable house. You can work with a real estate agent or search online listings. When you find a house you want to buy, make an offer to the seller.

Apply for the mortgage: After your offer is accepted, you’ll need to formally apply for the mortgage with the bank you’ve chosen. Submit all the required documents and complete the application forms. The bank will review your application, including your credit history, employment stability, and financial information.

Obtaining a house through a housing association (Dutch: “woningcorporatie”)

Usually you don’t have enough money to buy a house. Obtaining a house through a housing cooperative in the Netherlands typically involves the following steps:

Start with housing cooperatives: Start by researching and identifying housing cooperatives in your desired location. There are various cooperatives throughout the Netherlands, each with its own rules, requirements, and available properties. Explore their websites, contact them directly, or visit their offices to gather information.

Apply for a housing permit: In some municipalities you need a housing permit. You can request this from your municipality.

•

Comply with housing corporation requirements: The housing association may set requirements for the size of your family. Or the level of your income.

Membership and registration: To participate in a housing cooperative, you usually need to become a member. Check the specific requirements for membership, which may include criteria such as income limits or other eligibility criteria. Register with the cooperative by submitting the necessary documents and completing any application forms.

Joining waiting lists: Housing cooperatives often have waiting lists for available properties. Once you become a member, you may need to join the waiting list for the specific types of properties or neighborhoods you’re interested in. The waiting times can vary widely, ranging from a few months to several years, depending on demand and availability.

housing association (Arabic text)

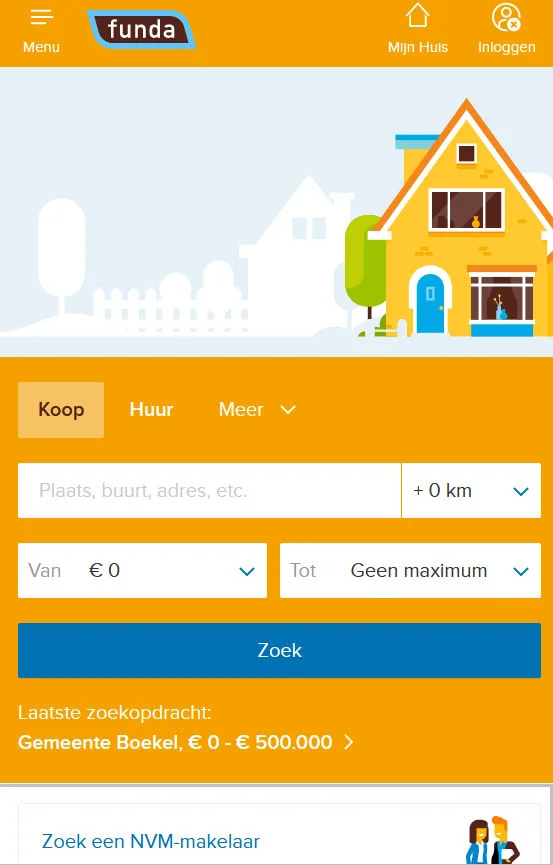

Website of Funda

Buying a house with a broker (Dutch: “makelaar”)

When buying a house with a broker, here are some important points to consider:

Choose a reputable and experienced broker: Take the time to research and select a reputable and experienced real estate broker. Look for recommendations, read reviews, and consider their track record in the market. A reliable broker can provide valuable guidance and support throughout the buying process.

Clearly communicate your needs and preferences: Be clear about your requirements, preferences, and budget with your broker.

Access to listings and market information: A broker will have access to a wide range of property listings and up-to-date market information.

Property viewings and inspections: Your broker will schedule property viewings for you to visit potential houses. Attend these viewings with your broker and thoroughly inspect the property.

Negotiation and offer preparation: When you find a house you’re interested in, your broker will assist you in preparing an offer and negotiating with the seller. They can provide guidance on pricing, market conditions, and terms of the offer. Rely on their expertise to help you secure a fair deal.

Contract and legal considerations: Once your offer is accepted, your broker will assist you in reviewing the contract and ensuring that all legal aspects are in order. They can work with you and your legal representative to address any contingencies, clarify terms, and ensure a smooth transaction.